Revenue Cycle Operations Innovation Achieves Impressive Results in Contrast to Industry Losses

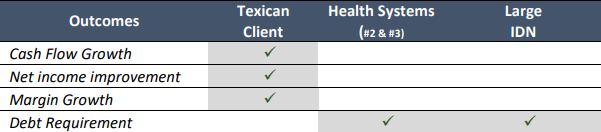

While America’s health systems have experienced significant impact from the COVID pandemic with ongoing financial instability and major net income losses as the COVID-19 pandemic continues to lengthen. Texican has been able to work with its clients to not only sustain but also improve cash collections and net income even during lower volume compared to pre-pandemic Even with significant declines in charges, there were no layoffs or need for additional debt to bolster cash reserves. This is in stark contrast to the industry that is forecasted to lose an estimated $54 billion in net income even considering CARES Act funding from last year with median hospital margins estimated to be 11% below pre-pandemic levels by year’s end and more than a 1/3 (third) of hospitals could end 2021 with negative margins. #1

The Client

Texican engaged with a large regional $750M plus non-profit healthcare organization located in the South to transform its Revenue Cycle Operations (RCO) and implement process improvement/standardization across the entity. The region has been ravaged by COVID and natural disasters, and taking these unforeseeable events into consideration, these improvements provided a strong foundation to enable growth through the impact of the COVID-19 pandemic and plunging patient volumes. Even with this impact on charges, cash in the fiscal year ending

September 30th, 2021, exceeded the previous year by $46.6M or 7.6%. “Our revenue cycle operations transformation partner, Texican has played a critical role in strengthening our system, increasing, and sustaining our annual cash flow by 10% over baseline, reducing A/R by 25%, and establishing an accurate and consistent revenue forecast model are only a few of the significant Texican contributions. Even during COVID-19 their support and Revenue Cycle leadership afforded us the opportunity to continue to grow cash while mitigating significant financial impacts experienced by other healthcare organizations. Their work helped to position our organization for the recent highly successful merger with Ochsner Health” … Large Regional Health System, Chief Financial Officer

The Results

Through the RCO engagement our client has been able to achieve cash Improvements totaling $248M, as well as 7.7% net revenue growth through 2021.

“Our revenue cycle operations transformation partner, Texican has played a critical role in strengthening our system, increasing, and sustaining our annual cash flow by 10% over baseline, reducing A/R by 25%, and establishing an accurate and consistent revenue forecast model are only a few of the significant Texican contributions. Even during COVID-19 their support and Revenue Cycle leadership afforded us the opportunity to continue to grow cash while mitigating significant financial impacts experienced by other healthcare organizations. Their work helped to position our organization for the recent highly successful merger with Ochsner Health.”

Texican Inc. specializes in achieving positive cash results through revenue cycle operations transformation. Established in 1991, we have been focused on delivering sustainable cash flow and operational improvement year over year. We have produced an equivalent average of an extra month of cash collections per engagement. As well as develop the performance metrics to continue the trend. Based on our experience clients achieve incremental cash improvement of $12 for every $1 spent on the engagement. For more information, please contact Juliana Costa, at juliana_costa@texicaninc.com or at (850)225-9376.

Reference:

# 1 Kaufmann Hall: September 2021 : “Financial Effects of COVID-19: Hospital Outlook for the Remainder of 2021”

# 2 May 2020 AHA article “Hospitals and Health Systems Face Unprecedented Financial Pressures Due to COVID-19”

#3 July 2020 AHA article “New AHA Report Finds Losses Deepen for Hospitals and Health Systems Due to COVID-19)